Перевод и анализ слов искусственным интеллектом ChatGPT

На этой странице Вы можете получить подробный анализ слова или словосочетания, произведенный с помощью лучшей на сегодняшний день технологии искусственного интеллекта:

- как употребляется слово

- частота употребления

- используется оно чаще в устной или письменной речи

- варианты перевода слова

- примеры употребления (несколько фраз с переводом)

- этимология

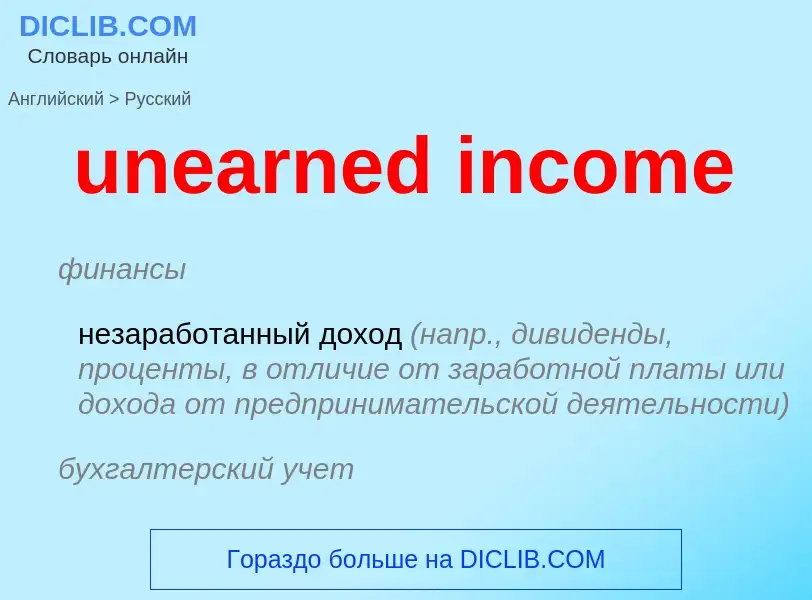

unearned income - перевод на Английский

финансы

незаработанный доход (напр., дивиденды, проценты, в отличие от заработной платы или дохода от предпринимательской деятельности)

бухгалтерский учет

доходы будущих периодов (полученный, но еще не заработанный доход, т. е. доход, полученный раньше срока (напр. арендная плата вперед); учитывается как текущие обязательства до момента отнесения на финансовые результаты отчетного периода)

экономика

непроизводственный доход, рентный доход

синоним

антоним

2) нетрудовой доход (напр. дивиденды, проценты)

3) "незаработанный доход", доход, полученный авансом

['ɪnkʌmtæks]

общая лексика

подоходный налог (на доход до 20 700 ф.ст. - 25%, свыше этого - 40%)

налог подоходный

сокращение

IT

финансы

подоходный налог (налог, взимаемый в виде процента от доходов физических лиц или домохозяйств)

американизм

налог на прибыль (налог, взимаемый в виде процента с прибыли юридических лиц)

синоним

Смотрите также

[dis'kreʃən(ə)ri'iŋkʌm]

экономика

часть личного дохода

остающаяся после удовлетворения основных потребностей

Определение

Википедия

Unearned income is a term coined by Henry George to refer to income gained through ownership of land and other monopoly. Today the term often refers to income received by virtue of owning property (known as property income), inheritance, pensions and payments received from public welfare. The three major forms of unearned income based on property ownership are rent, received from the ownership of natural resources; interest, received by virtue of owning financial assets; and profit, received from the ownership of capital equipment. As such, unearned income is often categorized as "passive income".

Unearned income can be discussed from either an economic or accounting perspective, but is more commonly used in economics.

![Payroll]] and income tax by OECD Country in 2013 Payroll]] and income tax by OECD Country in 2013](https://commons.wikimedia.org/wiki/Special:FilePath/Payroll and income tax by country.png?width=200)

![Denmark disposable income after tax<br> Not including [[Value-added tax]] or [[Property tax]] Denmark disposable income after tax<br> Not including [[Value-added tax]] or [[Property tax]]](https://commons.wikimedia.org/wiki/Special:FilePath/Denmark disposable income.webp?width=200)

![Germany disposable income after taxes <br> Not including [[Value-added tax]] or [[Property tax]] Germany disposable income after taxes <br> Not including [[Value-added tax]] or [[Property tax]]](https://commons.wikimedia.org/wiki/Special:FilePath/Germany disposable income after taxes.webp?width=200)